Corporate Financial Advisory Services

Growth Capital

Due Diligence

Sale Advisory

Executing the Sales Transaction

M&A Sales Process

Acquisition Advisory

Executing the Acquisition Transaction

M&A Acquisition Process

Growth Capital

PacStar Capital Partners has longstanding relationships with many of the top Private Equity firms in the world. Finding growth capital for your company involves not just identifying a source of funds, but, more importantly, obtaining those funds from the right partner. Banks simply loan money to companies. Private Equity firms can bring the same cash, but also lend specific expertise and many, many years of successfully growing companies and maximizing shareholder value. Some of the firms we deal with have been successfully investing in, partnering with and growing companies for over 100 years.The Private Equity firms we deal with are always interested in partnering with and/or acquiring companies in a myriad industries and locations. We can get you to these companies with one phone call.

In addition to its longstanding ties to Private Equity groups, Pacstar has partnered with a leading commercial funding group to provide 40 different types of business financing to companies. Loans types include:

|

|

Due Diligence

PacStar Capital Partners provides both financial and operational due diligence, which is a critical component of analyzing any business. Investors need to have a clear view of the strengths and weaknesses of a potential investment with respect to the technology and the marketplace. Sellers need to understand the strengths and weaknesses of their company to maximize value. We will assist in determining the technological feasibility and viability in the overall marketplace through a confidential, thorough assessment of operational and financial assets and liabilities, including interviews with inventors, customers and competition. Clients trust us to perform robust analysis, draw sound conclusions, and propose critical recommendations that may be overlooked by others. The key areas covered in a typical due diligence process include:- Company Description

- Company History

- Financial Information (Cash flow analysis, EBIDTA forecasting, working capital, earnings quality, sales pipeline, off-balance sheet assets, tax compliance and marginal rates, contingent liabilities and reserves)

- Legal

- Management and Organization (Experience, roles, reporting structure; personality and leadership diagnostics)

- Human Resources

- Market and Competition

- Operations (Process flows, business continuity risk, critical path analysis, bottlenecks and efficiencies, management, customer experience, scalability, regulatory landscape, SWOT analysis)

- Products/Services (Analysis of the products; product mix; price elasticity; target market; competitive landscape; marketing strategy; macro-trends)

- Evaluation of Information Technology Infrastructure (Team experience, data center, network topology, network/server architecture, operational risk, data redundancy, information and data security, software descriptions, functionality, user friendliness, mobile applications, development methodology, standard development life cycle (SDLC), build process)

- Insurance

Sale Advisory

The decision to sell a business is one, which many managers and owners make once in their lifetime. You have one chance to get it right. Are you selling too cheaply? Should you act now to realize your investment rather than risk further uncertainty?Often the decision to sell has to be made under great pressure, with a potential purchaser in the background, and with severe time constraints. We will assist you in evaluating your sale plan and develop a strategy to help achieve the results you require from a sale.

In assisting you to sell all or part of your business, we analyze your company and industry in detail. To determine a range of values, we identify the major players in your industry, the range of values or value multiples, your financial projections, and other value drivers.

We create a sale process based upon your objectives and then carefully manage the process from start to finish. Our goal is to minimize disruption to your business and to maximize not just the price of your business, but the after-tax proceeds as well as your goals, which may include non-monetary or intangible issues.

PacStar Capital Partners will be able to assist you in:

- Assessing shareholders' options and the viability of a sale

- Determining a range of value for your business and your equity in the business

- Developing the confidential offering memorandum

- Identifying qualified buyers worldwide, using our contacts and databases.

- Assessing financial and strategic appeal of each acquirer

- Negotiating, structuring, and closing the transaction

- Assisting with post-transactional issues

Executing the Sales Transaction

In order to achieve your business and financial objectives it will require negotiations expertise, tax and financial structuring skills, and due diligence experience. Our M&A advisory professionals will help you negotiate with buyers to maximize your sales price and with the assistance of your tax advisors structure your sale in a manner that will minimize taxes on your gain. PacStar has represented clients in numerous ways:- Assisting in preparing the data room

- Valuing alternative offers

- Negotiating the letter of intent

- Negotiating and structuring transactions

- Coordinating and managing the due diligence process by the acquirers advisors

- Arranging acquisition financing for buyers consisting of all types of debt and equity

- Developing alternatives and recommending appropriate courses of action

- Coordinating legal, tax, accounting and other closing-related activities

- Advising on contracts, reps, and warranties

- Assisting with negotiation of purchase price adjustments

- Assisting in transaction closing

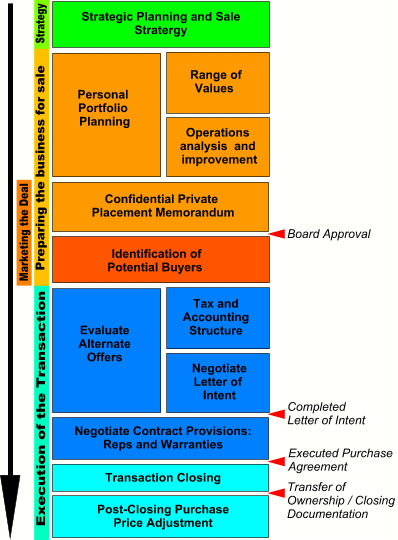

M&A Sales Process

Our M&A sales process links tasks to be completed into four strategic phases. The following chart presents a broad overview of the major M&A milestones and how they relate to each phase of the M&A methodology.

Acquisition Advisory

You have decided to make an acquisition in order to achieve your competitive, growth and financial objectives. Have you chosen the right target? Are you paying the right price? Have you structured a tax efficient transaction?Our M&A advisory professionals will assist you achieve your acquisition objectives and avoid pitfalls along the way by providing expert guidance at each stage of the acquisition process, from planning, to targeting, to execution.

We can assist you in carrying out a successful acquisition program from the initial strategic planning stage through completion of the transaction. PacStar Capital Partners has a wealth of contacts, relationships, databases and research capabilities, which is crucial to finding a pool of candidate companies that meet your acquisition criteria.

We are able to assist you through the whole process, while working closely with your management and advisors. Our acquisition advisory services include:

- Establishing or confirming acquisition goals and criteria

- Identifying and screening acquisition candidates

- Arranging and evaluating financing options

- Analyzing value drivers and synergies

- Creating and manipulating financial models

- Assisting with deal negotiations

Executing the Acquisition Transaction

Transaction execution is the key to minimizing the risks and maximizing the objectives of an acquisition. PacStar Capital Partners has developed a reputation for developing innovative transaction structures that help clients minimize taxes, maximize shareholder value, and obtain a competitive edge at the negotiating table.PacStar's extensive transaction experience and focused approach to due diligence assists in assuring that its clients' priority transaction issues are addressed early, and deal-breakers exposed, before substantial resources are expended.

PacStar Capital Partners' services include:

- Conducting a range of values for the acquisition

- Performing financial, and operational due diligence

- Performing financial structuring

- Reviewing contracts and covenants

- Assisting with negotiation of purchase price adjustments

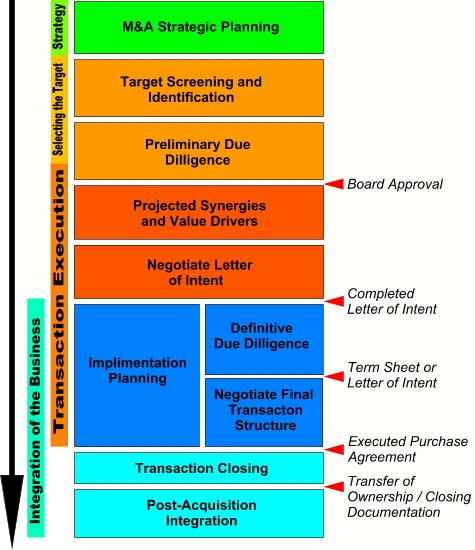

M&A Acquisition Process

Our M&A acquisition process links tasks to be completed into four strategic phases. The following chart presents a broad overview of the major M&A milestones and how they relate to each phase of the M&A methodology. A robust M&A strategy is the critical component for capturing long-term shareholder value.